When stock is repurchased for retirement, the stock must beremoved from the accounts so that it is not reported on the balancesheet. The balance sheet will appear as if the stock was neverissued in the first place. Even though the company is purchasing stock, there is no assetrecognized for the purchase.

Reissuing Treasury Stock above Cost

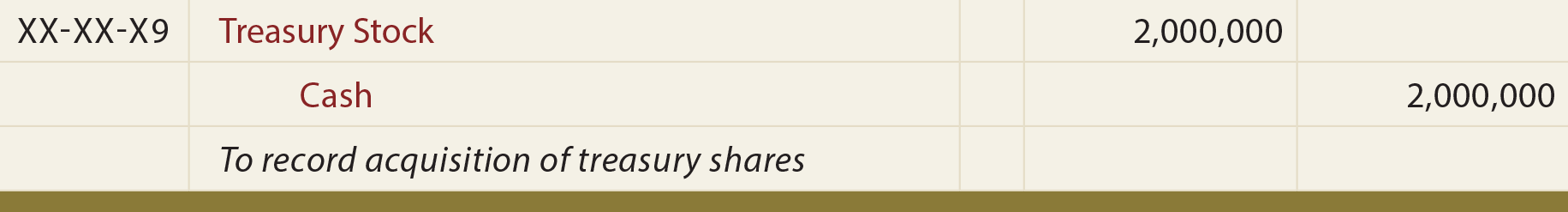

Duratech will pay the market price of the stock at $25 per share times the 800 shares it purchased, for a total cost of $20,000. The following journal entry is recorded for the purchase of the treasury stock under the cost method. There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. Both types of stock dividends impact the accounts in stockholders’ equity. A stock split causes no change in any of the accounts within stockholders’ equity.

- When stock is repurchased for retirement, the stock must beremoved from the accounts so that it is not reported on the balancesheet.

- To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend.

- A purchase can also create demand for the stock, which inturn raises the market price of the stock.

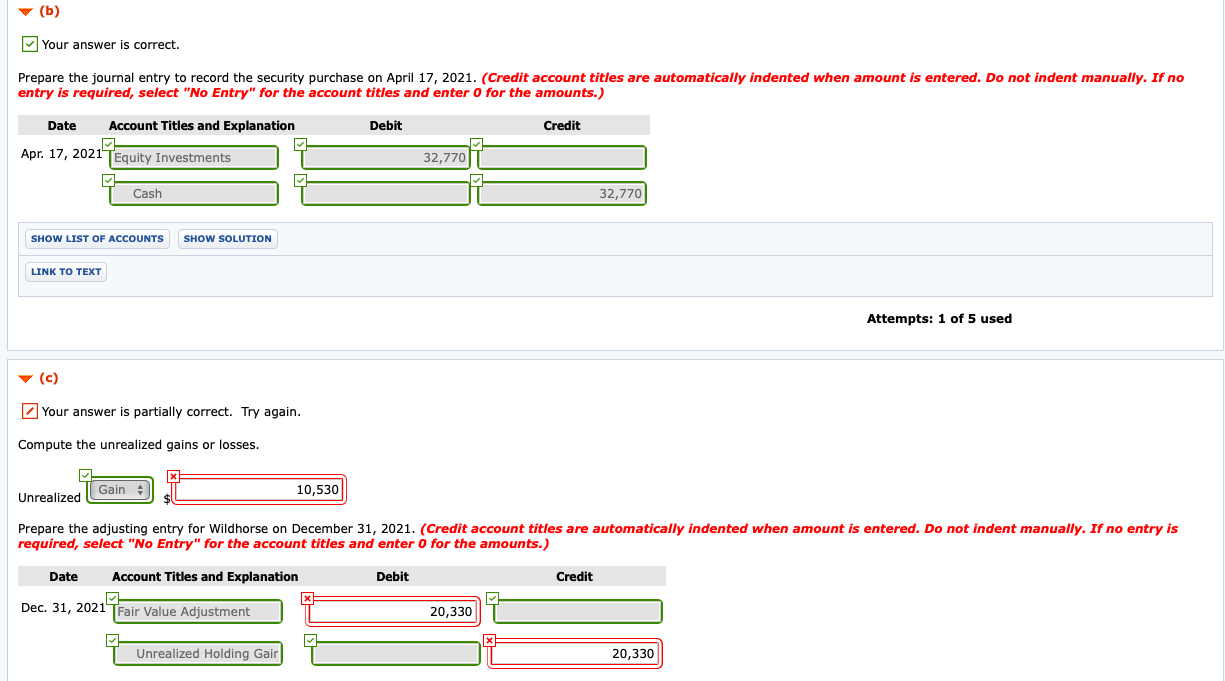

- So when the company purchases other shares, it has to record this investment as the marketable security.

- Because shares held in treasury arenot outstanding, each treasury stock transaction will impact thenumber of shares outstanding.

Popular Contents $type=blogging$count=6$author=hide$comment=hide$label=hide$date=hide$hide=home$s=0

A small stock dividend is viewed by investors as a distribution of the company’s earnings. Both small and large stock dividends cause an increase in common stock and a decrease to retained earnings. This is a method of capitalizing (increasing stock) a portion of the company’s earnings (retained earnings). After the distribution, the total stockholders’ equity remains the same as it was prior to the distribution. The amounts within the accounts are merely shifted from the earned capital account (Retained Earnings) to the contributed capital accounts (Common Stock and Additional Paid-in Capital).

Accounting treatment

Prior to the distribution, the company had 60,000 shares outstanding. The difference is the 3,000 additional shares of the stock dividend distribution. The company still has the same total value of assets, so its value does not change at the time a stock distribution occurs. The increase in the number of outstanding shares does not dilute the value of the shares held by the existing shareholders. The market value of the original shares plus the newly issued shares is the same as the market value of the original shares before the stock dividend. For example, assume an investor owns 200 shares with a market value of $10 each for a total market value of $2,000.

or Services

Because the sales price of these shares ($27,000) is less than the reported balance ($28,000), recognition of a $1,000 loss is appropriate. This loss reflects the drop in value that took place during Year Two. Investors, though, may also embrace a strategy of acquiring enough shares to gain some degree of influence over the other organization.

Reporting Treasury Stock for Nestlé Holdings Group

Immediately after the purchase, the equitysection of the balance sheet (Figure14.6) will show the total cost of the treasury shares as adeduction from total stockholders’ equity. Even though the company is purchasing stock, there is no asset recognized for the purchase. Immediately after the purchase, the equity section of the balance sheet (Figure 14.6) will show the total cost of the treasury shares as a deduction from total stockholders’ equity.

Often, profitable synergies can be developed by having two companies connected in this way. For example, at the end of 2008, The Coca-Cola Company (CCC) held approximately 35 percent of the outstanding stock of Coca-Cola Enterprises (CCE), its primary bottler and distributor. CCC does not own sufficient shares to control the operations of CCE but it certainly can apply significant influence if it so chooses. For example, on January 1, we have made a $200,000 investment in shares of another company with the name of ABC Corporation. This $200,000 investment in shares that we have bought represents 1% of shares of ownership in the ABC Corporation. Some companies do not need the capital, but they have surplus cash.

So, there is no impact on the total assets on the balance sheet of the company ABC. A large stock dividend occurs when a distribution of stock to existing shareholders is greater than 25% of the total outstanding shares just before the distribution. The accounting for large stock dividends differs from that of small stock dividends because a large dividend impacts the stock’s market value per share. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. Notice on the partial balance sheet that the number of commonshares outstanding changes when treasury stock transactions occur.Initially, the company had 10,000 common shares issued andoutstanding. The 800 repurchased shares are no longer outstanding,reducing the total outstanding to 9,200 shares.

This will depend on how much ownership the company has in other companies. You are correct when you buy stock personally but, in this case, the OP purchased the business by acquiring 100% of the company’s stock. Similar to when you purchase a business in an asset sale and you record the assets purchased as assets on the balance sheet, the stock purchased in a stock sale sits on the books as assets. At the time dividends are declared, the profitability index calculator board establishes a date of record and a date of payment. The date of record establishes who is entitled to receive a dividend; stockholders who own stock on the date of record are entitled to receive a dividend even if they sell it prior to the date of payment. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record.

Recent Comments