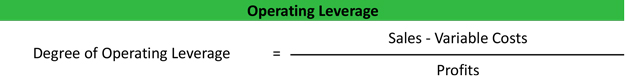

Not all corporations use both operating and financial leverage, but this formula can be used if they do. A firm with a relatively high level of combined leverage is seen as riskier than a firm with less combined leverage because high leverage means more fixed costs to the firm. The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs.

Great! The Financial Professional Will Get Back To You Soon.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. These two costs are conditional on past demand volume patterns (and future expectations).

What does a high DOL indicate?

Under all three cases, the contribution margin remains constant at 90% because the variable costs increase (and decrease) based on the change in the units sold. Intuitively, the degree of operating leverage (DOL) represents the risk faced by a company as a result of its percentage split between fixed and variable costs. Companies with a high degree of operating leverage (DOL) have a greater proportion of fixed costs that remain relatively unchanged under different production volumes. The company’s overall cost structure is such that the fixed cost is $100,000, while the variable cost is $25 per piece. This tool helps you calculate the degree of operating leverage to understand how your company’s earnings might change with varying sales levels. The operating leverage formula is used to calculate a company’s break-even point and help set appropriate selling prices to cover all costs and generate a profit.

What is the approximate value of your cash savings and other investments?

Finally, it is essential to have a broad understanding of the business and its financial performance. That’s why we highly recommend you check out our otherfinancial calculators. We will discuss each of those situations because it is crucial to understand how to interpret it as much as it is to know the operating leverage factor figure. By calculating your DOL and comparing it with industry benchmarks, you can assess your business’s efficiency and competitiveness.

How confident are you in your long term financial plan?

For example, a software business has greater fixed costs in developers’ salaries and lower variable costs in software sales. In contrast, a computer consulting firm charges its clients hourly and doesn’t need expensive office space because its consultants work in clients’ offices. Operating Leverage is a financial ratio that measures two teach limited the lift or drag on earnings that are brought about by changes in volume, which impacts fixed costs. Many small businesses have this type of cost structure, and it is defined as the change in earnings for a given change in sales. Even if sales increase, fixed costs do not change, hence causing a larger change in operating income.

- This does not only impact current Cash Flow, but it may also affect future Cash Flow as well.

- The calculator will provide the DOL value, which indicates the sensitivity of a company’s operating income to changes in sales volume.

- The degree of operating leverage (DOL) measures how much change in income we can expect as a response to a change in sales.

- For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%.

- However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible.

What Is the Difference Between Operating Leverage and Financial Leverage?

If sales revenues decrease, operating income will decrease at a much larger rate. It is important to understand that controlling fixed costs can lead to a higher DOL because they are independent of sales volume. The percentage change in profits as a result of changes in the sales volume is higher than the percentage change in sales. This means that a change of 2% is sales can generate a change greater of 2% in operating profits. Other company costs are variable costs that are only incurred when sales occur. This includes labor to assemble products and the cost of raw materials used to make products.

This result indicates that for every 1% increase in sales, EBIT increases by 1.5%. DCL is a more comprehensive measure of a company’s risk because it takes into account both sales and financial leverage. We’ll go over exactly what it is, the formula used to calculate it, and how it compares to the combined leverage.

The higher the degree of operating leverage (DOL), the more sensitive a company’s earnings before interest and taxes (EBIT) are to changes in sales, assuming all other variables remain constant. The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings. In the base case, the ratio between the fixed costs and the variable costs is 4.0x ($100mm ÷ $25mm), while the DOL is 1.8x – which we calculated by dividing the contribution margin by the operating margin.

Conversely, retail stores tend to have low fixed costs and large variable costs, especially for merchandise. Because retailers sell a large volume of items and pay upfront for each unit sold, COGS increases as sales increase. Operating leverage measures how a company’s fixed costs affect its profitability as sales volume changes. In simpler terms, it tells you how sensitive your operating income (or EBIT—Earnings Before Interest and Taxes) is to changes in sales. The more operating leverage a company has, the more its profits will rise (or fall) with changes in sales volume.

Recent Comments